Continuous Moments of Truth Revealed by Westpac Wonder

-

2016

-

Service

Commercial Services

Designed By:

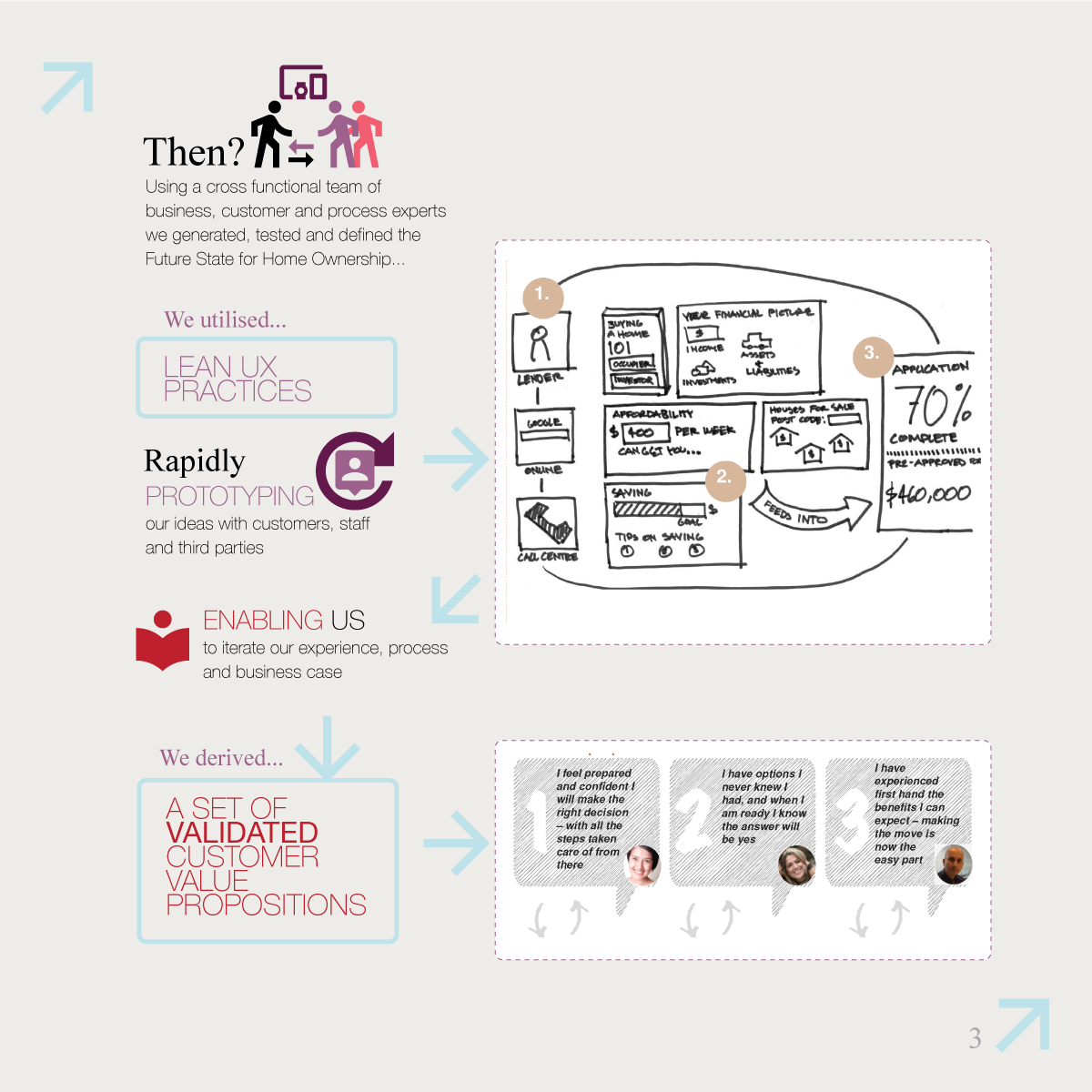

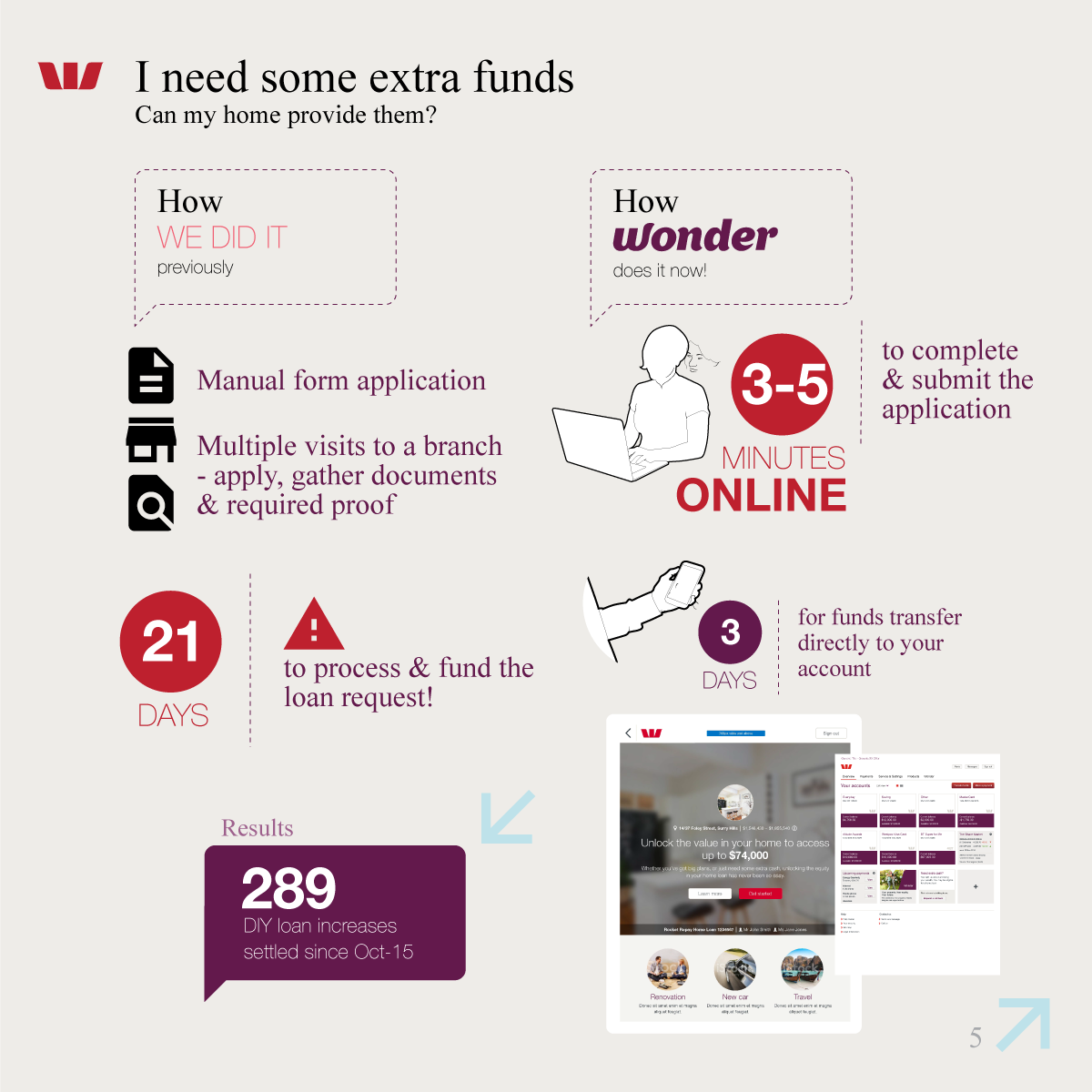

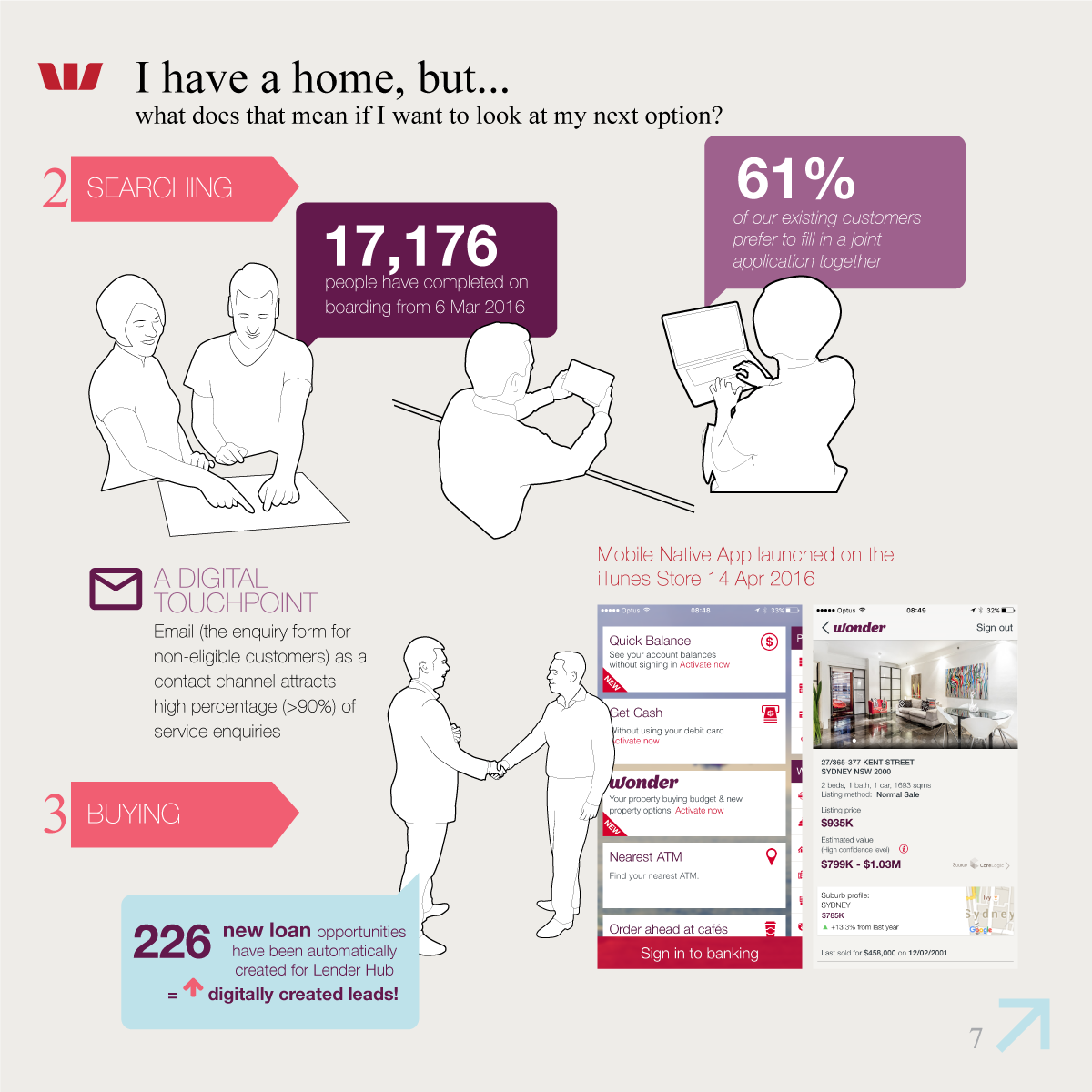

Owning a home is dream for many Australians, but today’s processes can sometimes make it difficult. Westpac Wonder changes the way we inform and engage with customers about their borrowing options. A customer insight driven design approach allows customers to understand their borrowing power, like no bank has done before.